Class of 1966 Gift Projects

GIFT REPORTS 2021 •

WHAT WE DID - AND DO - TOGETHER

Our Class Reunion Gifts have each been chosen to support a university priority and to enhance the Cornell undergraduate experience in a critical and creative way.

“ThrivingRED” West Campus Residential House Programming (50th Reunion Gift)

“ThrivingRED” supports Sophomores and Juniors living in the West Campus Program Houses through programs and activities in their residential houses that develop skills to cope with stress (both academic and personal), to increase resilience, and to learn lifelong skills not simply to survive, but to thrive. The House Deans’ Fund provides the resident deans in all five houses with financial support for them to work, both separately and together as student needs may dictate, to bring services from Cornell Health as well as programs and activities from other campus organizations to their students right where they live.

’66 beebe beach (25th Reunion Gift)

When Beebe Lake was being dredged in the early 1990s, our class gift funded the use of the dredged material to create a recreational area on the north shore of the lake. Initially covered in grass and abundant with flowers, the area has been designated by Cornell Botanic Gardens gradually to become a natural partially-wooded habitat. It remains easily accessible to North Campus residents as a place for casual walks – a refuge from the stress of courses, exams, and grades. The 1991 circle of young sycamores has grown to a grove of soaring trees, not far from the rock and plaque that welcome visitors and commemorate our Class Gift.

Class of 1966 Ezra Scholarship (35th Reunion Gift)

Our Cornell Class of 1966 Ezra Scholarship was established as part of the University’s campaign to increase its financial aid and “need blind” program, to ensure Ezra’s founding vision that Cornell be accessible to “Any Person.” Each year, Cornell selects an undergraduate who needs scholarship assistance and who embodies involvement in projects and programs beyond the classroom. One goal of our scholarship is to ensure that the Class develops a personal relationship with each recipient beyond the monetary award. We have reached out to present and past '66 scholars to learn more about their time on the Hill and where their Cornell education and dreams have taken them.

Becker House Dean’s Fund (40th Reunion Gift)

Becker House, one of five residential houses built to create an Upper Class West Campus Community where the U-Halls once stood, is named for history professor Carl Becker whose characterization of the University as providing “Freedom with Responsibility” has become Cornell’s “second motto.” This Fund enables the resident House Dean/Professor to offer programs and services that enrich the undergraduate experience for students living there: faculty and staff guest speakers; speakers from outside the Cornell community; activities organized by the House’s Resident Advisors and Student Council; and trips to places in and around Ithaca, and even New York City. READ MORE about our class’s strong and lasting relationship with Becker House.

AFF: Annual Fund First” (45th Reunion Gift)

This Class Gift addressed the University’s need to expand its Annual Fund, which provides current use dollars, offering flexibility to react to unseen needs, take advantage of new opportunities, support a program or a student, close a gap, make possible a faculty hire, etc. It enables the University to address situations each year that the annual budget would not have foreseen. In supporting the drive to triple Cornell’s Annual Fund, ’66 classmates were encouraged to follow “Your Passion + Plus”: “Each Year, Every Year, before making a gift to one’s passion, include a gift to the Annual Fund First.” That Spring, the percentage of ‘66 classmates supporting the Annual Fund became the highest of any Cornell class.

A Special Note

Each December, the class officers, in memory of classmates who have passed away that year, make a donation from our class treasury to one or more of our Class Projects, increasing the value of each endowed fund. Your faithful support of the class by paying your class dues each year enables the class treasury to remain strong and able to support these gifts.

Class of 1966 Scholarship

Book Value: $62,622

Support Provided FY 2022:$2,909

Class of 1966 Becker House Dean's Fund

Book Value: $238,142

Support Provided FY 2021: $10,417

Class of 1966 Thriving Red Fund

Book Value $162,436

Support Provided FY 2021:$4,543

55th Reunion Class Gift

GOAL: $55,000

RAISED: $142,590

(over $100,000, thus creating our fourth endowment, a gift in perpetuity)

.

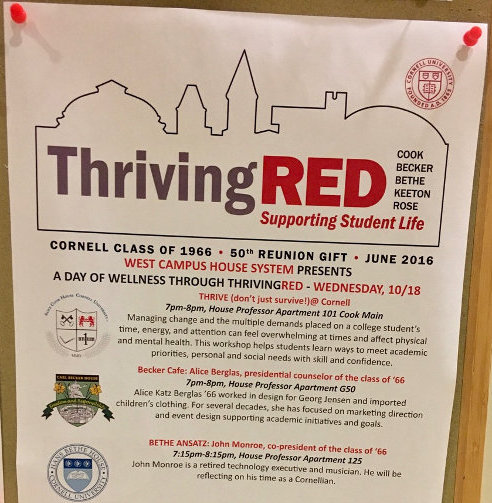

Poster announcing Thriving RED presentations by class officers John Monroe and Alice Berglas

Thriving RED:

Our 50th Reunion Class Gift

Supporting Student Wellness

"THRIVING RED"will provide West Campus Sophomores and Juniors with funding for resources - bringing a myriad of programs and activities to 1800 students EXACTLY WHERE THEY LIVE.

It establishes a House Deans' Fund for all five Deans to work collaborativelv. to draw on the services of Gannett and upon programs already existing on campus.

An important goal of our 35th Reunion "Cornell Class of 1966 Ezra Scholarship" is to ensure that the Class creates a personal relationship with each recipient beyond simply the monetary award. With renewed commitment, we are reaching out to present and past '66 scholars to learn more about their time on the Hill and where their Cornell educations and dreams have taken them.

Destiny Smith, Class of '66 Scholarship Student to graduate in 2024

I hope this letter finds you well. My name is Destiny Smith and I'm a senior (!!) studying biology in the College of Arts and Sciences. I 've been a recipient of the Class of 1966 scholarship since coming to Cornell and I'm writing today to thank you for your continued support of my education and give updates. Here are just some things that you might remember:

>- l'm a first-generation college student , from Delaware

>- I've gradually engaged in extracurricular and work opportunities on campus

>- I'm a pre-med student with a concentration in neurobiology & behavior and a minor in linguistics.

This past year, I continued my involvement in the Kessler Scholars Program as a mentor,my pre health sorority as an officer, chess club, work at the library, and I still play some recreational volleyball. Although a lot of my involvement consists of continuing the same activities, a lot has changed as well. I'm now an officer for the First-Gen Student Union on campus. I joined a new lab over the summer through the Nexus Scholars Program that's made me ponder seriously about my career. I'm starting my honors thesis research officially next week looking at how a specific same-sex behavior impacts dopamine activity in the brain and what this could mean in the broader functional context. I loved research in this lab over the summer so much that I can't imagine not working in research in some capacity in the future. I'm planning to use this senior year's project and time after graduation to really figure out if an MD/PhD or DO/PhD is what best suits my passions.

On that note, I decided to take about two gap years after graduation to gain more useful healthcare experience, get more involved in my home community as a leader, and prepare for my medical school applications. This was a difficult deci sion to make but I'm confident it was the right one. I'm free to fully enjoy my senior year without the additional pressure of graduate school applications as well as knowing whether I submitted a competitive enough application. I'm excited to be the first in my family to graduate college and really use my degree to give back to my home community for a while before continuing my educational journey.

Classes are going well. I'm actively looking for opportunities to get involved in the broader Ithaca community. In general, I'm feeling very optimistic and ambitious. In my fourth year on campus, I truly feel Cornell is my second home. Everyday I'm reminded of all the people I'm able to connect with, places I'm able to go, and potential I'm able to capitalize on without much financial stress. As always, I'm extremely grateful for your contribution to my education. Thank you for your continued support in my journey! If you wish to write back or ask for updates along the way, feel free to email me at das627@cornell.edu. A special hello to John and Rolf. I hope we can meet in person soon! Thank you, again!

Sincerely,

Destiny

For more information on scholarships and other gifts, please contact:

Janine M. RossAssociate Director of Donor Relations

Cornell University

130 E. Seneca Street, Suite 400

Ithaca, NY 14850

Phone: 607.254.6142

Email: jmh265@cornell.edu

1966 Becker House Dean's Fund

Book value: $238,142Support Provided FY 2021: $10,417

To learn more about Becker House, visit:

http://cornellclassof66.org/Becker/Becker.htm

Also, visit Becker House's Facebook page at:

https://www.facebook.com/groups/383959171638625/

And, of course, '66 beebe beach continues to welcome undergraduates and alumni as a glorious respite from the hectic life that is Cornell. Indeed, together, we have made a difference. Wonderfully so!

54% to faculty and Program Support

28% to Student Financial Aid

9% to Special Inititatives and Projects

9% to Campus and Facilities Improvements

Your gift helps Cornell advance its mission of teaching, research, and public service, and prepares our students to become tomorrow's leaders. Gifts to Cornell are tax-deductible to the full extent of the Internal Revenue Code.

You can make a gift to Cornell online: Click here. Cornell University Planned Giving

Gifts That Pay You Income

Do you want to support Cornell, but worry about having enough income for yourself and your loved ones? Life-income gifts such as gift annuities and charitable remainder trusts can provide donors with an income stream, significant tax savings, and the satisfaction of providing Cornell University with vital, long-term resources.

The creation of a life-income gift benefits both the giver and the receiver, a "win-win" situation. The following life-income gifts are available, and one may be right for you.

To learn more, click here:

Cornell University Planned Giving